Table of Contents

You may wonder what is FICO? Well, a FICO Score is a three-digit number based on the information in one’s credit report. It lets lenders assess how likely a loan is to be paid back by that person.

When someone applies for a loan, lenders need a clear and concise way to determine whether to lend money or not. So they look at FICO Scores in most instances.

What Is FICO Score?

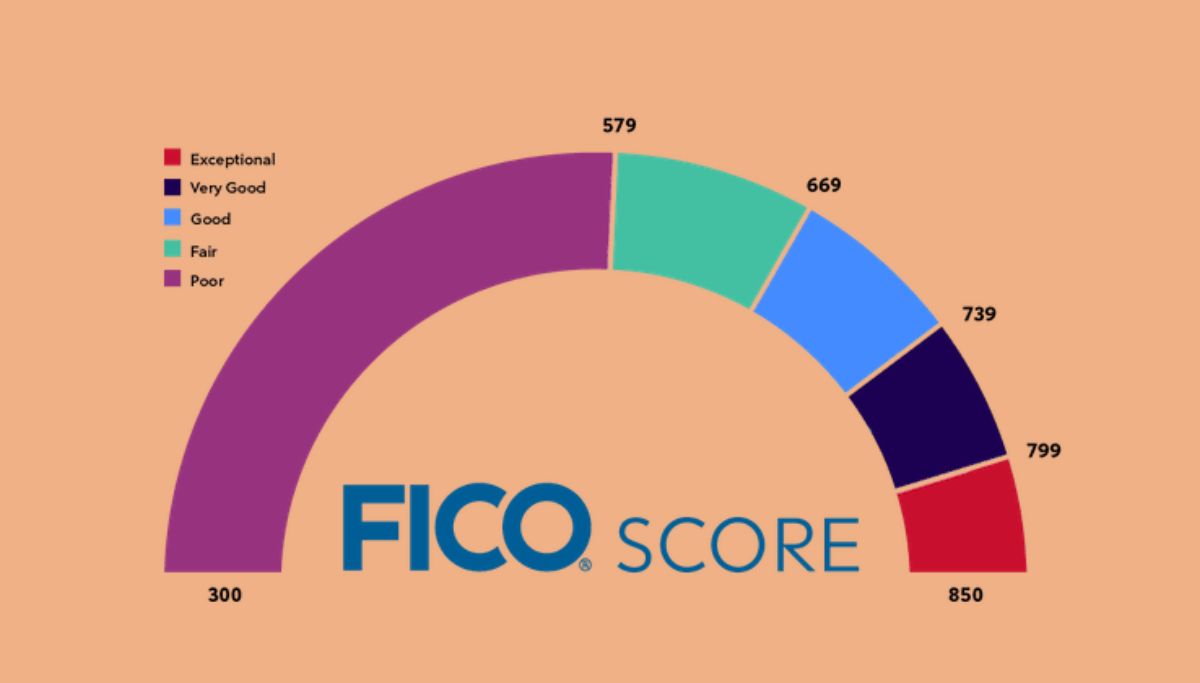

A FICO Score is a loan rating provided by the Fair Isaac Corporation (FICO). It can be considered as a summary of the credit report. To analyze credit risk and decide whether to increase credit, lenders use borrowers’ FICO scores along with other information on borrowers’ credit reports. To assess creditworthiness, FICO scores take into account five areas: payment history, the current level of indebtedness, types of credit used, length of credit history, and new credit accounts. The highest fico score possible is 850.

Importance Of FICO Score | What Is FICO?

To understand what is FICO, you must learn how to improve FICO Score by understanding its importance. FICO Scores help millions of individuals get access to the credit they need to do stuff like getting an education, buying a first home, or paying medical expenses. When setting up the terms of the service, even some insurance and utility businesses will review FICO Ratings.

The fact is since lenders are more likely to extend lower rates if there is less risk for them, a strong FICO score can save thousands of dollars in interest and fees.

And overall, decent, fast, reliable, and predictive scores help the entire population as a whole to keep the cost of credit lower. The more credit is available, the more creditors can lend, and the more effective they can be in their processes to lower costs and pass savings on to the borrowers.

How Are Credit Scores Calculated?

Now that you know what is FICO, let us understand how are credit scores calculated. You’re sure to get thousands, if not hundreds, of credit scores. This is since the credit score is determined by adding a statistical formula to the details in all of the three credit reports, and there is no common standardized algorithm utilized by all lenders or other financial institutions to measure the ratings. (Some credit score models are very similar, such as the FICO® score, which ranges from 300 to 850.)

You don’t have to get hung up on getting several ratings, however, since the variables that make the scores go up or down in various performance models are typically identical. It’s still going to be the same factor that lets one score go up and down—it just depends on the degree.

Many models take into consideration your background and credit card usage background, how much available credit you use on a daily basis, how long you’ve had accounts available, the kinds of accounts you have, and how much you qualify for new credit.

How To Improve FICO Score? | What Is FICO?

Fico vs credit score: Start by reviewing your credit scores online to boost your scores. When you receive your ratings, you can also get details regarding the variables that most influence your scores. These risk factors can help you realize the adjustments you should make to start improving your ranking. You may need to give some time for any adjustments you make to be recorded by your creditors and mirrored in your credit scores.

Certain credit score considerations are generally more relevant than others. Payment background and credit use ratios are among the most significant in many crucial credit score models, and together they can account for up to 70% of the credit score, which implies that they are extremely powerful.

Focusing on the above acts can continue to improve the credit ratings over time. The credit score illustrates the trend of credit purchases over time, with further focus on recent records. We hope this answers your question on “What is the highest fico score” and how to improve it.

Pay Bills On Time

When lenders check the credit report and ask for a credit score, they are very interested in how an individual pays his bills reliably. This is because the performance of past payments is commonly considered a strong indicator of future performance.

When an individual pays his bills on time as decided per month, his credit scoring is positively influenced. Similarly, it may adversely impact credit ratings by paying late or settling an account for less than what was initially agreed to pay.

Unsure of which loans to get? Get a FREE consultation by filling the form in this blog!

Apply For New Credit Accounts Only As Required

Don’t open accounts just to get a better credit mix. This probably won’t change the credit score.

In many ways, excess credit can decrease the credit score, from producing too many difficult inquiries on the credit report to enticing to overspend and accumulate debt.

Don’t Close Down Unused Credit Cards

Keeping unused credit cards open is a good strategy, as long as they cost any money in annual fees, because closing an account may increase the credit utilization ratio. Credit scores can be lowered by owing the same amount but having fewer open accounts.

Obtain Credit For Making Utility & Mobile Phone Payments On Time

There is a way for a person to increase his fico credit score by factoring in certain payments via a new free product called Experian Boost if he has been making utility and cell phone payments on time.

Consumers can allow Experian to connect to their bank accounts via this new opt-in product to identify utility and telecom payment history. A modified FICO Score will be delivered in real-time after a customer verifies the data and confirms they want it added to their Experian credit file.

Pay Twice A Month

Let’s just assume that you’ve had a tough couple of months in your finances. You would need to repair your deck (raising my hand) or get a new refrigerator. If you add huge things on your credit card to receive incentives, you will briefly drop your usage ratio (and your credit score) out of the box.

Do you remember why you made a call to get the closing date? Pay two weeks until the closing date and then submit another deposit shortly before the closing date. This, for instance, means that you have the funds to pay off your huge expenditure before the end of the month.

Be sure not to use a large bill credit card if you’re going to bring a balance. Compound interest would easily build an awful amount of debt. Credit cards can never be used on long-term lending until you have a zero-per cent promotional APR card on transactions. Even though you ought to be aware of the amount on your card to make sure that you can pay off the bill until the intro time is finished.

Dispute The Inaccuracies In Your Credit Report

You can search the credit reports at the credit checking offices for any inaccuracies. Incorrect details on your credit reports could pull your scores down. Verify that the accounts mentioned in the records are accurate. If you notice any mistakes, challenge the details and have them fixed instantly. Monitoring your credit on a daily basis will help you identify inaccuracies until they can inflict harm.

Pay Off Debt & Keep Balances Low On Credit Card & Other Revolving Credit

In credit score calculations, the credit utilization ratio is another significant figure. It is determined by adding at any given time all a person’s credit card balances and dividing the number by his total credit cap. For instance, if A normally charges around $2,000 per month, and his total credit limit is $10,000 for all his cards, his utilization ratio is 20%.

Typically, lenders want to see low ratios of 30% or less, and individuals with the highest credit scores also have very low credit utilization ratios. The ratio of credit utilization can be positively affected by:

- Paying off debt and keeping balances of credit cards low.

- Becoming an approved consumer on account of another person (as long as they use credit responsibly).

Establishing Or Building Your Credit Scores

If you actually don’t have a credit score and you have no credit knowledge or background, you’re likely to have a slim credit sheet. This indicates that you have little (if any) credit accounts reported on your credit records, usually one to four. Generally, a thin file implies that a bank or insurer is unwilling to determine a credit report since there is not enough detail in the user’s credit background to do so.

There are items you can do to fatten up your slim credit file, such as filing for a protected credit card, being an approved recipient of someone else’s credit card, or borrowing from a credit builder.

Final Word

If you want to improve your credit score, there are two simple guidelines you ought to follow:

First of all, hold the credit card balances low.

Second, pay your bills on time (and in full). Do these two items and then throw yourself in one or more of the sly ways above to offer your score a kickstart.

And remember—you don’t have to hold the balance to create a decent score. If you do so, you’re on the slippery slope to debt.

We hope that you liked reading this blog on “What is FICO Score and how to improve it?” If you did, then make sure you check out our other informative blogs linked below!

0 Comments