Table of Contents

Do copies of the Federal Student Loan Promissory Note have to be supplied by the Department of Education? If not, how can I get the debt confirmed? And what if they haven’t got all the pages? And how to get a copy of the student promissory note?

You’re entitled to copies of promissory notes, direct loan master promissory note on the student loan. Also, the only way to get them is not the Department of Education. There are many ways to find information about your federal student loans.

Read More About Abroad Education Loan

How to Get Your Student Loan Promissory Note Documents?

To get your federal student loans, the Department of Education has copies of all of the master promissory notes you have signed. By going to studentloans.gov and entering your FSA ID, you will get a copy of your Master Promissory Notes, direct loan master promissory note. Under the menu bar heading that says “My Loan Documents,” click on “Completed Master Promissory Notes.” The completed Master Promissory Notes, direct loan promissory note will appear, and you can import them directly.

If what you’re searching for is a copy of the entire federal student loan register, take a peek at the Freedom of Information Act, not just the promissory note, but also any other data the Department of Education has for you.

The Freedom of Information Act enables you to get federal government documents and details as long as it does not fall under the privacy or national security restrictions. You should be fine, and the student loan details do not fall under any of these exemptions for the student loan promissory note.

At this point, through either StudentLoans.gov or via a Freedom of Access Act request, you should be able to validate the fact that the debt is yours. There are other ways of confirming the loan, though.

Logging in to the National Student Loan Data System or NSLDS will be the third method. NSLDS is the primary financial assistance website for the US Department of Education, and it lets you see all about your federal student loans and grants. It’s like a federal student loan credit sheet, and it can give you a reasonably good idea of what’s unpaid.

By getting in contact with your school, the fourth way to get your loan details is. Your school will provide you with information on your attendance expenses and how payments have been charged.

The organization that sends you bills per month, your loan servicer, will be able to supply you with documents of your federal student loans. The role of the servicer is to handle the loan as long as it’s not in default. The servicer will provide details on your loan’s accounting, how fees were paid, payments collected, forbearances and deferments, and other activities related to the account. If your loan is in default, contact the Department of Education’s Default Resolution Group at 800-621-3115. The Default Resolution Group would let you know which servicer treated the loans while they were in good standing.

Borrowers of defaulted loans may request the debt collector for the loan information. You may not get it, but it’s an alternative.

How To Get A Complete Promissory Note?

If you are being sued over an outstanding loan by the government, you can seek copies of your papers during pre-trial discovery. If the government is unable to produce the entire note, they would generally say that you have earned the value of the loan funds and tuition has been paid if you can show that the tuition and fees were charged by you or someone else, that will defeat the case of the Education Department. This claim can not go far without such proof, however.

You can ask for an administrative hearing to request the student loan promissory note information if the Department of Education has not filed a lawsuit and uses an administrative collection remedy. You should be prepared, as with lawsuits, to show that you or anyone else paid the tuition and fees.

Avoid the Temptation

In the absence of a legitimate issue, it is tempting to obtain a copy of the Federal Student Loan Promissory Note, student loan master promissory note, but refusing to pay the federal student loan is typically a bad decision.

If you have been the victim of identity fraud or some other unauthorized action, there are administrative forms to get a federal student loan forgiven. When those appeals are rejected, you will need to file a complaint against the Education Department.

FAQs

1. What is a promissory note for a loan?

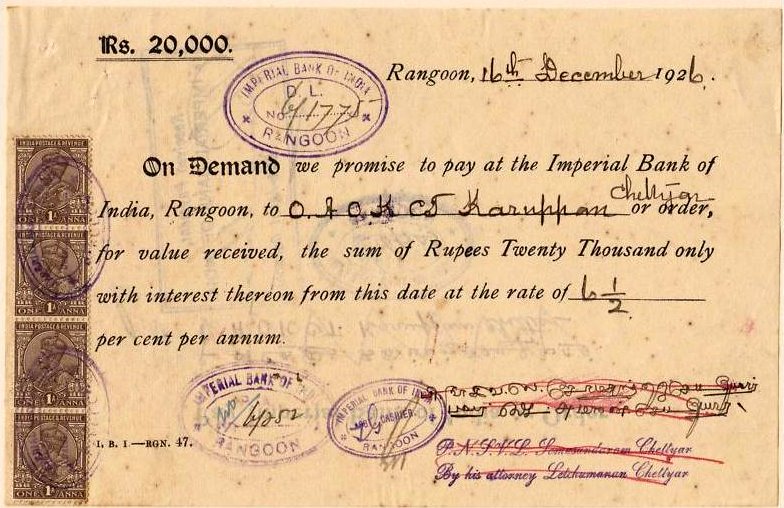

A promissory note is a legal document that outlines the terms of a loan, including the loan amount, interest rate, repayment terms, and default provisions. It is a legally binding contract between the borrower and the lender.

2. How long does MPN take to process?

The processing time for MPNs can vary depending on the completeness of your application and the volume of applications being processed. However, MPNs are typically processed within 2-4 weeks.

3. How do I find my MPN?

Your MPN can be found on your Student Aid Report (SAR) or your National Student Loan Data System (NSLDS) report. You can also contact your loan servicer to obtain your MPN.

4. What is the interest rate for MPN?

The interest rate for MPNs is variable and is based on the 10-year Treasury note plus an add-on factor. The current interest rate for MPNs is 5.24%.

5. What is the grace period for MPN?

The grace period for MPNs is six months after you graduate, leave school, or drop below half-time enrollment. During the grace period, you are not required to make payments on your MPN.

0 Comments