Table of Contents

The moment you start planning to study abroad, the first thing that comes to your mind is how to finance the whole thing. Education loans might seem like a debt commitment, and personal financing can shake your savings and other financial safety nets.

But to take that big step, choosing between the two is a must! This blog will compare abroad education loans vs. self-finance to study abroad so that you can make a better choice.

Self Financing International Studies

Self-financing international study means paying for your education completely out of your own pocket without taking out any loans.

With self-financing international studies, the student and their family are responsible for the entire cost of education and living expenses abroad. This includes fully utilising savings, income, etc.

Student Loans For International Studies

Today’s students are more career-oriented and want quality education to help them succeed. Borrowing money from family and friends has become prohibitively expensive, so it’s nearly impossible to fund the entire education with savings.

Abroad Education loan help students with insufficient money to pay for living expenses and tuition abroad.

Education Loans Vs. Self-Finance To Study Abroad- What’s The Difference?

There is a vast difference between taking out an education loan and self-finance. Whether to self-finance an abroad study or take an education loan depends on your financial situation.

But for those who have unstable financial backing, an education loan would be a better option, as it doesn’t empty your pockets all at once, but helps you bifurcate your income in a better way once you finish off your education and get employed.

The table given below shows the main differences between the two aspects:

| Education Loans Vs. Self Finance For Study Abroad- Overview | ||

| Feature | Education Loan | Self-Financing |

| Funding Access | Provides access to top universities regardless of upfront costs | Requires significant existing financial resources |

| Financial Burden | After graduation, manageable repayments spread the cost over time | Full payment is required up front, potentially affecting other financial goals |

| Investment Potential | You can view it as a long-term investment | Reduces the amount of funds available for other investments |

| Credit Building | Helps build a positive credit history for future loans (e.g., mortgage) | Doesn’t directly impact credit score |

| Government Support | Subsidies or tax breaks may be available | Limited access to government financial aid programmes |

| Flexibility | Offers repayment plans that fit your post-graduation income | Requires stricter budgeting during studies |

| Peace of Mind | Reduces financial stress during studies, allowing you to focus on academics | Potential financial pressure due to upfront costs |

Types Of Education Loans For Study Abroad

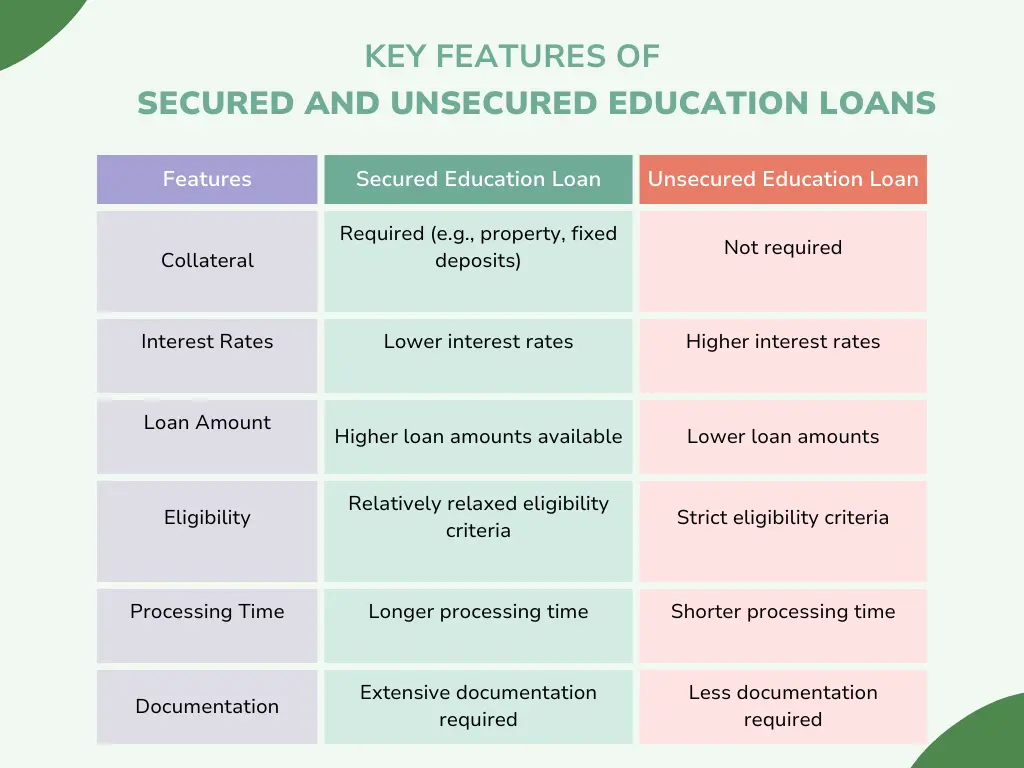

You might have heard that an education loan needs collateral. But that’s not completely true. You can even take an unsecured or without collateral loan. This facility reflects the support an education gives to students coming from different financial backgrounds.

Given below are the features of a secured and unsecured education loan:

Education Loans Vs. Self-Finance To Study Abroad: Managing Finances

As you can see, there are different types of education loans and only one way of self-financing. Studying abroad requires smart ways of managing money.

Given below are some tips to manage through both ways:

| Self-Financing Tips | Education Loan Tips |

| Start saving early for educational expenses | Research and compare different education loan options |

| Invest in growth-oriented funds/instruments | Check eligibility criteria and documents required |

| Seek scholarships/grants proactively | Opt for secured loans to get lower interest rates |

| Consider part-time jobs/freelancing | See if employer offers education loan assistance |

| Explore crowdfunding platforms | Explore government education loan schemes |

| Cut down on unnecessary expenses | Estimate accurate fund requirements to avoid over-borrowing |

| Seek family support/contributions | Maintain a good credit score for better loan terms |

| Liquidate low-risk investments/assets | Explore education loan tax benefits |

| Rent out extra property, if available | Understand repayment schedule and plan accordingly |

| Opt for an affordable study program | Consider loan repayment assistance programmes |

Education Loans Vs. Self-Finance To Study Abroad: Which Is Better?

As mentioned earlier, self-financing or education loans depend on your capacity and cost of education. However, to study abroad, there needs to be a lot of money at your hand, excluding the investments, to qualify for a planned self-financed study abroad journey. If not, then education loans can help you fulfil your dreams and even not burden you with debt. Let’s look at more such points below:

Self Financing:

- You’ll need to use up your savings and valuable assets like gold, fixed deposits, insurance policies, property, etc., which can be stressful and risky. However, you will only owe money to people once you pay for everything.

- There are no monetary benefits directly from self-funding. You’re solely relying on your resources.

- Universities often require proof of your financial capability, typically needing around a year’s worth of expenses plus extra in your bank account to show you can manage the costs.

- You or your family might have to save up for a long time or gather a large sum quickly, which can be difficult.

- Managing all your expenses, such as tuition, rent, food, etc., can be quite challenging as you’re funding everything from your own pocket.

- Changes in currency values and inflation can affect the overall cost of your education, adding to the financial strain.

- Building a good credit history might be challenging because you won’t have a loan repayment record to show responsibility in managing debts.

Student Loans:

- Taking a loan can avoid liquidating your savings and assets, giving you a safety net in case of emergencies.

- Student loans typically come with lower interest rates, flexible repayment options, and sometimes government subsidies, making them more financially manageable.

- The bank provides a solvency letter confirming your financial capability to the university, which helps secure your admission.

- You can enjoy a repayment holiday during your course term plus extra time before repaying the loan.

- The bank disburses funds regularly, covering your expenses without gathering a large sum at once.

- Your loan amount usually covers all major expenses, such as tuition, accommodation, food, etc., making budgeting easier.

- Regarding managing your education costs, currency fluctuations do not affect education loans.

- Section 80E of the Income Tax Act lets you deduct the interest you pay on education loans.

Self-funding requires you to use up your resources, which can be financially risky and stressful. Student loans, however, give you the money you need with manageable repayment terms, so you don’t spend all your savings.

FAQs

1. Is it advisable to take an education loan for studying abroad?

It is advisable to take an education loan for studying abroad, given the higher cost of learning.

2. Which is better: a personal loan or an education loan?

An education loan is better than a personal loan as these loans offer lower interest rates than personal loans.

3. Is it better to take an education loan or use savings?

It’s better to take an education loan than to use savings. Education loans have flexible repayment plans that do not harm your pocket, and you can easily pay the amount from your income.

4. Can I take a personal loan and go abroad for my studies?

Yes, you can take a personal loan and go abroad for studies, but it’s recommended that you take an education loan as it has a larger moratorium and grace period as compared to personal loans.

5. What are the benefits of an education loan over a personal loan?

An education loan has many benefits, such as larger grace periods, interest subsidies, tax benefits, and lower interest rates.

6. Is taking an education loan risky?

No, an education loan is a low-risk type of loan which can be paid over a 10-15 years duration on a flexible repayment plan.

0 Comments