Table of Contents

Student loans make it much easier to handle finances abroad. Whether you are studying for an undergraduate or graduate degree, you must know about the pros and cons and features of your education loans according to your degree. Undergraduate and graduate student loans differ in many ways. Let’s get to the basics of the difference between undergraduate and graduate abroad education loan in this blog!

What Is The Difference Between Undergraduate & Graduate Abroad Education Loan?

Undergraduate student loans are for those starting their higher education after the 12th class. On the other hand, postgraduate student loans are for students advancing their career after undergraduate studies, for example, masters and doctoral students. That’s pretty obvious, right? But wait, there’s more!

Generally speaking, the undergraduate student loan borrowing limit is relatively less than the graduate student loans. Whereas for graduate student loans, the borrowing limit is high, as they are taking up doctoral or masters degrees, the advanced level of education can cost more tuition and hence the higher limit. Refer to the table below for more details:

| Difference Between Undergraduate & Graduate Abroad Education Loan – Overview | ||

| Feature | Undergraduate Loan | Postgraduate Loan |

| Target Education Level | Bachelor’s Degree (after 12th grade) | Masters, M.Phil., Ph.D. (after Bachelor’s Degree) |

| Loan Coverage | Typically covers tuition fees and living expenses | Primarily covers tuition fees (living expenses might be included depending on the lender) |

| Loan Amount | Generally lower than postgraduate loans | Can be higher than undergraduate loans due to potentially higher tuition fees for specialised programmes |

| Interest Rates | It can vary depending on the lender and borrower profile but is generally comparable to postgraduate loans | Interest rates might be slightly higher than undergraduate loans due to perceived higher risk for doctoral studies |

| Repayment | It starts after a grace period following graduation | Starts after a grace period following graduation |

Additional Points:

- Both loans are disbursed in instalments.

- The lender might set specific eligibility criteria (e.g., academic merit, college accreditation).

Difference Between Undergraduate & Graduate Abroad Education Loan Eligibility Criteria

To be precise, there’s not much difference between the eligibility criteria for loans to students for undergraduate and graduate studies. However, there might be potential differences. Read through the points below to understand this:

Common Eligibility Criteria:

Given below are some of the common eligibility criteria for undergraduate and graduate student loans, which require:

- The student to be over 18 years of age and hold Indian citizenship.

- The student should be good at academics and have maintained a good academic score.

- The student should’ve pursued a full-time programme at a well-known university.

- The student should apply with a co-applicant, who should be parent/legal guardian.

- Certain programs could have specific eligibility criteria (e.g., entrance exam scores for professional degrees).

- Confirmed admission to the selected programme.

Potential Variations:

Apart from the above given standard requirements, there are a few differentiating factors you must consider, like:

- Undergraduate loans may have lower maximum limits than postgraduate loans due to the potentially higher costs of specialised postgraduate programmes.

- Some lenders might have stricter academic record requirements for postgraduate programmes, such as GPA/SGPA scores, attendance, etc.

- A good credit score (if applicable) can improve loan approval chances and help secure a lower interest rate.

Difference Between The Undergraduate & Graduate Abroad Education Loan Documents

The documents you submit for the undergraduate and postgraduate loans are similar but might vary for one or two reasons. The table given below shows this:

| Document Category | Undergraduate Loan | Postgraduate Loan |

| Mandatory Documents | ||

| Loan Application Form | Required | Required |

| Admission Documents | Offer letter, Fee Structure | Offer letter, Fee Structure |

| Academic Documents | Marksheets (10th & 12th), Previous Degrees | Marksheets (All Degrees), Previous Degrees |

| Identity Proof | Passport/Voter ID/Aadhaar Card | Passport/Voter ID/Aadhaar Card |

| Co-applicant Income Proof | Salary Slips/ITR | Salary Slips/ITR |

| Bank Statements | Co-applicant’s bank statements may be required | Yours or Co-applicant’s bank statements may be required |

| Potential Variations | ||

| Additional Programme Documents | Not as common | Might be required for specific programs (e.g., entrance exam scores) |

| Government Scheme Documents | Not applicable unless applying for specific schemes | Income certificates or other documents as per scheme requirements |

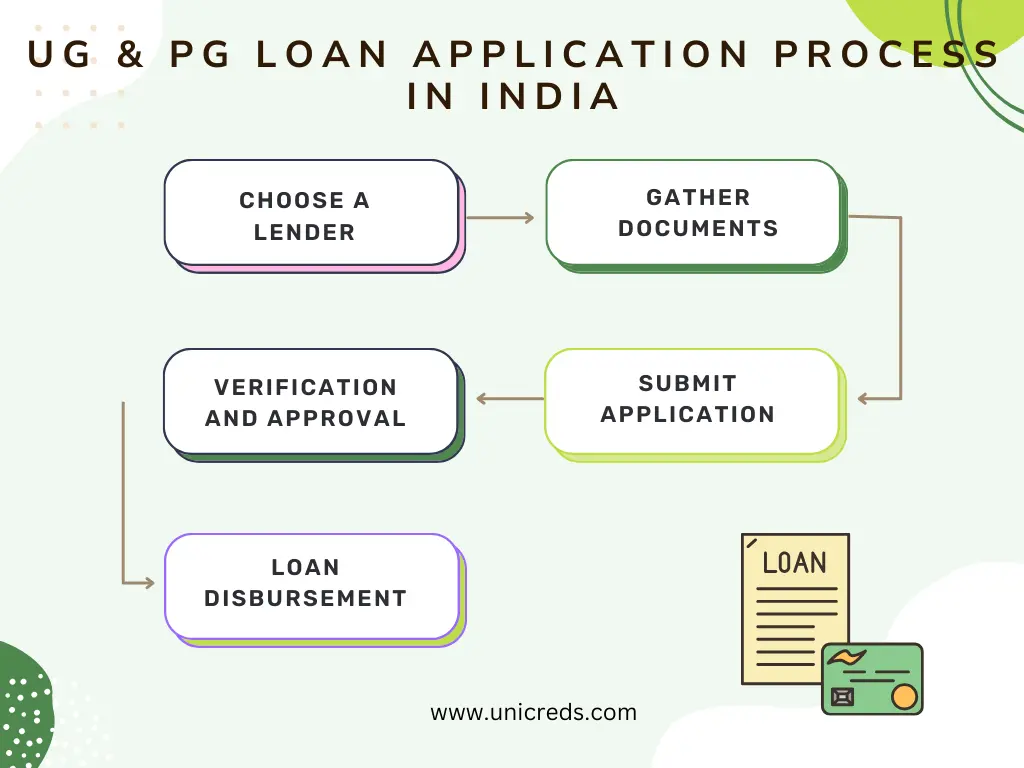

Difference Between Undergraduate & Postgraduate Education Loan Application Process

Regarding the differences, India’s loan application process is the same for all courses. Just the eligibility and document requirements vary between the two. Look at the image below to understand the loan application process in general:

Difference Between The Repayment Terms Of Undergraduate & Graduate Student Loans In India

Here’s a breakdown of the critical differences in repayment terms for undergraduate and postgraduate student loans in India:

Similarities:

- Both loan types offer a grace period after graduation (typically 6 months to 1 year) before you need to start making repayments.

- Most lenders offer similar repayment options, like fixed monthly instalments (EMIs) or income-based repayment plans (may vary by lender).

Potential Differences:

- Due to higher loan amounts, undergraduate loans might have a shorter maximum repayment tenure (typically 10-15 years) than postgraduate loans (which can go up to 15 years).

- There might be slight variations in interest rates, with postgraduate loans carrying a slightly higher interest rate due to the perceived higher risk associated with specialised studies.

- Deferment options (temporarily pausing repayments) might be more available for postgraduate loans due to longer programme durations or research components. However, specific terms depend on the lender.

For postgraduate education loans, you can even opt for income-driven repayment plans, loan consolidation, undergraduate and graduate subsidised loans, etc.

For more information on graduate and undergraduate student loans, take expert advice from UniCreds!

FAQs

Can I get a student loan for an undergraduate degree?

Yes, you can get student loans for an undergraduate degree from various banks and NBFCs in India.

Can I get an education loan for graduation?

You can get an education loan for graduation at higher borrowing limits in India.

Can a graduate apply for a loan?

Yes, a graduate can apply for a student loan and obtain higher loan amounts and interest rates.

What is the eligibility for student loans?

Eligibility for a student loan includes Indian citizenship, a good academic record, a good CIBIL score, and the requirement of a co-applicant.

Is it better to study abroad for UG or PG?

Yes, studying abroad for UG or PG is better as it increases the chances of employment and gives better ROI.

Which type of education loan is best?

Undergraduate and graduate education loans are both best as they offer various subsidised loan schemes and flexible repayment plans.

0 Comments