Table of Contents

Established in 1994 as UTI Bank, Axis Bank has grown to become the third-largest private commercial bank in India. With a firm commitment to financial empowerment, Axis Bank plays a pivotal role in facilitating education by providing loans for students looking to pursue their studies in India or abroad.

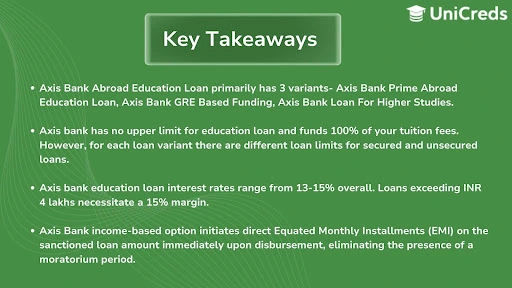

Axis Bank provides loans as low as Rs. 50,000 with no upper limit funding 100% of the cost of your education. In this blog, we will delve into the intricacies of Axis Bank Abroad Education Loan offerings, for students.

Axis Bank Education Loan Variants

Axis Bank Education Loan stands as a reliable partner for students aspiring to pursue higher education abroad, offering a range of tailored education loan options. Below is an in-depth exploration of the various study-abroad loan variants provided by Axis Bank.

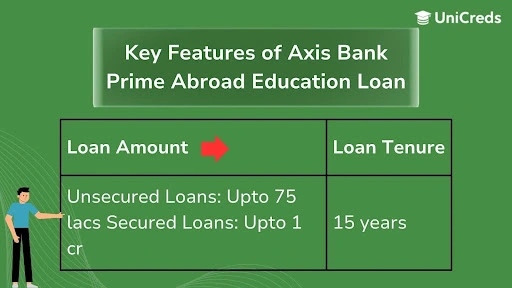

Axis Bank Prime Abroad Education Loan Product

This loan scheme helps students get funds to realise their dreams of pursuing higher education at premier educational institutions abroad.

The following table states the key features of the Axis Bank Prime Abroad Education Loan:

Axis Bank GRE-Based Funding:

The GRE-based funding loan is tailored for students who meet the eligibility criteria based on their GRE scores. The GRE, commonly mandated by international universities for admission to graduate and professional programs, serves as the benchmark for qualification.

For applicants who demonstrate excellence in their GRE performance, this loan presents an opportunity to secure financial support with potential concessions on collateral, based on their GRE score.

| GRE Scores | Loan Amount Available |

| Between 300-315 | Up to INR 30 lakhs without collateral |

| Above 316 | Up to INR 40 lakhs without collateral |

Axis Bank Education Loan For Higher Studies

Axis Bank Education Loan is particularly for the students aspiring to study in both- India and abroad. This loan is for post-secondary studies abroad.

| Loan Amount | Loan Tenure |

| Unsecured Loans Upto – 40 lacs Secured Loans – 1Cr. | Up to 10 years |

Axis Bank Education Loan Interest Rates

Axis Bank student Loan interest rates are tied to the Reserve Bank of India’s Repo rate. The bank introduces a margin over the repo rate, and this margin is influenced by various factors, including the loan amount, repayment tenure, collateral value, and the borrower’s credit rating.

Below are the existing interest rates for Axis Bank education loans, categorised by the loan amount:

| Loan Amount | Effective Interest Rate* |

| Up to INR 4 lakhs | 15.20% |

| From INR 4 lakhs to INR 7.50 lakhs | 14.70% |

| Above INR 7.50 lakhs | 13.70% |

Axis Bank Collateralised Vs. Non-Collateralised Education Loan Product

Axis Bank provides collateral and non-collateral loans too. Both loans have different features and requirements. Let’s look at each of them separately.

Axis Bank Collateralised Education Loans

- The loan limit for a collateralised Axis education loan is 1 Cr.

- The expenses covered are tuition fees, living expenses, one-way airfare, books, stationery, laptop costs, and health insurance.

- The accepted co-applicants under this loan type are parents, siblings, and spouses.

- The value of collateral should be at least 1.25 times the value of the said loan amount.

- Accepted collateral – immovable property, LIC policy, government bonds, Fixed Deposits.

Axis Bank Education Loans Without Security

- The loan limit for non-collateralised Axis Bank Education Loan is 50 lacs.

- Expenses covered are- tuition fees, hostel/mess charges, books and stationery, laptop/computer purchasing costs, one-way airfare etc.

- The accepted co-applicants are – parents, parents-in-law, siblings etc.

Upfront Repayments Required On Axis Bank Study Abroad Education Loan

Axis Bank Education Loan mandates fees and specifies margin requirements for certain loan amounts.

- Upfront Processing Fees: Limited to a maximum of 2% of the loan amount.

- Margin: Loans exceeding INR 4 lakhs necessitate a 15% margin, disbursed pro-rata at each loan disbursement.

Moreover, if you opt for property collateral, you will be responsible for covering out-of-pocket expenses related to property evaluation and legal appraisal.

Axis Bank Abroad Education Loan Eligibility Criteria

Understanding the eligibility criteria for Axis Bank Abroad Education Loans is crucial, ensuring that students can confidently pursue their dreams of studying abroad. In this section, we will discover the essential prerequisites and qualifications that pave the way for securing financial support from Axis Bank.

- To be eligible for the Axis Bank Abroad Education Loan, the applicant must be an Indian citizen.

- A minimum of 50% in Class 12 and during graduation is a prerequisite for prospective loan applicants.

- Eligibility extends to those who have secured admission in a STEM (Science, Technology, Engineering, and Mathematics) course for higher studies.

- A qualifying factor includes a co-applicant with a CIBIL score exceeding 600.

- Successful applicants must provide evidence of a stable income for the co-applicant, establishing financial reliability for the education loan.

Axis Bank Education Loan Income-Based Product

Axis Bank Foreign Education Loan income-based product offers Axis Bank non-collateral education loans to students aiming to pursue their desired courses in their chosen country, based upon the income of their co-applicant.

Unlike some other education loan products, the Axis Bank income-based option initiates direct Equated Monthly Installments (EMI) on the sanctioned loan amount immediately upon disbursement, eliminating the presence of a moratorium period.

This product consists of two types of co-applicants, each with distinct requirements and features. Let’s delve into each category individually:

For Salaried Co-applicant:

- Acceptable Locations: Serviceable in most metropolitan cities across various states in India.

- Salaried Co-applicant Income (Per Month):

| Income Range | Unsecured Loan Amount (Max. Limit) |

| 50k – 65k | 10 lacs |

| 65k – 70k | 15 lacs |

| 70k – 90k | 20 lacs |

| 90k – 1.2 lacs | 30 lacs |

| More than 1.2 lacs | 40 lacs |

For Self-employed Co-applicant:

As per Axis Bank student Loan guidelines, a self-employed co-applicant must:

- Have a business under sole proprietorship.

- Possess ITR (amount not considered).

- Run the business for a minimum of 3 years.

- Reside at one address for at least 12 months.

- Maintain a minimum CIBIL score of 700.

- To assess the loan amount eligibility for the Axis income-based product for self-employed co-applicants, four parameters are considered:

| Cash Profit of the Company / Saral Income | Unsecured Loan Amount (Max. Limit) |

| >= 7.5 lacs | 15 lacs |

| >= 10 lacs | 30 lacs |

| >= 20 lacs | 40 lacs |

Understanding the distinct criteria for each co-applicant type allows applicants to navigate the Axis Bank income-based product effectively and secure suitable financing for their educational dreams.

Axis Bank Abroad Education Loan- Required Documents

Documents needed for securing an education loan from Axis Bank overseas education loan are specific and essential. Below is a detailed list of the required documents:

KYC Documents for Student and Co-Applicant or Guarantor:

- Proof of Identity:

- Address Proof:

- Personal and salary bank account statements for the last 6 months (showing crediting salary if salaried), and 1 year of business transactions (if self-employed).

- Asset and liability statements are evaluated by a bank professional. All documents must be self-attested.

Academic Documents for Student:

- Marksheets and certificates of Class 10th, 12th, and Degree.

- Fee breakdown provided by the college or university in writing.

- Admission proof highlighting the course duration.

- Qualifying examination scores are declared by the respective authorities.

Income Documents for Co-Applicant:

If Salaried:

- Latest Salary Slips (for the last 3 months).

- Form 16 of the last 2 years.

- ID card of the company where the applicant is employed.

- Last 2 years’ Income Tax Return.

If Self-employed:

- Last 3 years’ Income Tax Return.

- Proof of address for the business.

- Last 3 years’ Balance Sheet showing profit & loss statements (only if self-employed).

Other Documents:

- A written statement from the co-applicant expressing their commitment to cover expenses not covered by the loan.

- A joint affidavit between the applicant and co-applicant in the bank’s format.

Additional Documents (if applicable):

- Statement of the loan account for the past year (if any pending).

- Proof of payment (if any) made in advance.

- Letter of explanation for any backlog or gap in studies on a Rs. 100 stamp paper.

Collateral Documents (Optional):

- Students opting for education loans with collateral must submit specific collateral documents.

- Collateral requirements vary by state, and applicants should consult their financial officer for a detailed checklist based on eligibility.

While this is a general document list, specific bank requirements may apply. From application to distribution, there are numerous steps in the student loan procedure. It might be lengthy and perplexing at times. UniCreds instruction and support will guide you through the entire procedure with relative simplicity. Our education loan advisors will be available to you at all times to assist you.

How To Apply For Axis Bank Abroad Education Loan?

Whether you choose the convenience of applying online or prefer the traditional offline method, Axis Bank Study Loan ensures a straightforward process to help you secure the amount you need for your academic endeavours.

Online Application:

- Navigate to the Axis Bank official website.

- Fill in the required information, including your name, mobile number, email ID, state, and city, and specify if you are an existing customer. Complete the captcha.

- Confirm your agreement to the terms and conditions and proceed by clicking ‘Submit’.

- An Axis Bank representative will reach out to you to facilitate the further processing of your loan request.

Offline Application:

- Visit Axis Bank branch:

- Obtain an application form from your nearest Axis Bank branch.

- Complete Form and Submit Documents:

- Fill out the application form and submit it along with the necessary supporting documentation.

The bank will initiate the processing of your application upon receipt of the completed form and required documents.

Axis Bank Education Loan Repayment Policies

Axis Bank’s repayment process for abroad education loan involves students initially paying simple interest on the loan amount during the moratorium period. Following this period, monthly EMIs become applicable, calculated based on factors such as the interest rate, type of interest (simple/compound), repayment duration, and a semester-wise breakdown of fees.

For precise EMI calculations, leverage the UniCreds education loan EMI calculator a free, highly accurate tool that provides detailed results, offering a strategic edge in financial planning.

While Axis Bank Education Loan extends a repayment duration of 15 years, encompassing the moratorium period, many students seek ways to expedite the loan settlement.

Here are effective tips for student loan repayment-

- Make lump-sum prepayments or part payments towards the principal amount to reduce the overall loan burden and accelerate the repayment process.

- Choose a shorter repayment tenure if feasible. While this may increase monthly EMIs, it ultimately leads to quicker loan closure and reduced interest payments.

- Explore the option of transferring your education loan to take advantage of better interest rates or more favourable terms, potentially reducing the overall repayment burden.

FAQs

Q1. How much time does Axis Bank take to convey its decision?

Upon receiving a complete and comprehensive education loan application, Axis Bank will communicate its decision within 15 working days from the date of application submission.

Q2. What is the margin for Education Loans in Axis Bank?

For education loans up to Rs. 4 Lakhs, no margin is required. However, for loans exceeding Rs. 4 Lakhs, a margin of 5% is applicable for studies within India, while a margin of 15% is applicable for studies overseas.

3. What are the charges for late payment of EMI?

In case of a bounced cheque, there will be a charge of Rs 500 plus applicable taxes. Additionally, an overdue instalment will incur a penal interest of 24% per annum, equivalent to 2% per month.

4. What is the limit of an education loan in Axis Bank?

Axis Bank offers education loans starting from a minimum amount of INR 50,000 with no maximum limit, providing funding for up to 100% of the total cost of education. This comprehensive coverage includes expenses such as course fees, living expenses, and travel costs.

5. Is it easy to get an education loan from Axis Bank?

With Axis Bank Education Loans, you can easily finance various aspects of your education, including tuition fees, hostel charges, study materials, and more. The Bank ensures a seamless and efficient loan process, offering quick approval and disbursement of funds upon submission of the application and required documents.

6. Is Axis Bank good for education loan?

The Axis education loan not only assists students in meeting their financial needs for studying abroad but also provides a 100% tax benefit on the interest paid, as per Section 80(E) of the Income Tax Act.

7. Can I get 20 lakhs education loan without collateral in Axis Bank?

You can take up to Rs. 75 Lakhs loan without collateral from Axis Bank.

0 Comments